The short answer is yes! There could be many reasons why you need to add someone else’s name to your mortgage or title deed, but probably the most common ones are marriage, and moving in with a partner.

The situation around legal rights to property for cohabiting couples can be problematic as there is not yet the same recognition for couples living together that there is for those who are married. If you are in this situation, it might be worth considering changing the ownership of your home or property, and adding your partner to the title deed. This process is known as transfer of equity.

What are the different types of joint property ownership?

There are two different types of legal home ownership in England and Wales:

1. Joint tenancy: Under joint tenancy, the whole of a property is shared between two people, who each have an equal right in it. This is the case even if one partner contributed more to buying the house. If one partner dies, the whole of the property then automatically passes into the name of the surviving tenant. This is called the Right of Survivorship.

2. Tenants in common: Under this type of home ownership, two parties can own a property together. In most cases, this is a straightforward 50/50 split, but it could be higher or lower depending on the individual circumstances. For example, one partner could have a 60% share because they contribute a larger amount to the mortgage.

In this case, when one partner dies, their proportion of the property will be passed on according to their will or in line with the laws around inheritance if they died without having a will in place.

Both of these options are perfectly valid and suit different situations. It’s important to think carefully about which one is right for you before you decide to change ownership.

Changing solely-owned property into joint ownership

Changing a property into joint ownership is a fairly straightforward process, although it can take several weeks, depending on your individual circumstances. While you can complete some parts of this process yourself, you’ll need a conveyancing solicitor to help with some elements. You can find further information here: https://www.samconveyancing.co.uk/news/conveyancing/transfer-of-equity-process-3894.

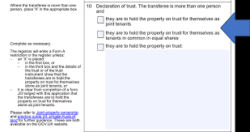

The first stage of completing the transfer is to update the Title deeds of your property. Your solicitor can do this by contacting HM Land Registry. Your solicitor can then create a Transfer Deed, outlining the new joint ownership of the property. You might also make a Declaration of Trust, especially in the case of a joint tenancy, as this outlines both parties’ share in the split, allowing you both to have peace of mind.

Don’t forget that your mortgage provider will also need updating with the change from single to joint ownership.