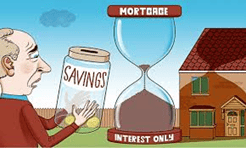

Mortgages can be paid off in two ways. The most common is that of the repayment mortgage. This is where you pay an amount off the interest and off the capital, the actual amount you have borrowed unitil the debt is cleared. You then own the Property. The other way of paying off the mortgage was the Interest only option. In this mortgage you just pay off the interest generated by the amount that you owe. However, whilst the monthly repayment might be considerably lower than the repayment option at the end of the term you still owe every penny that you borrowed at the beginning. Regardless of which one you get you will still need some Online conveyancing.

The problem with historic Interest Only Mortgages is that lenders were not strict on what they would allow. You needed to have a repayment vehicle but that could be anything. Some anecdotal reports suggest answers of “I will win the Lottery” were accepted. The most common was “I will sell the property before the end of the term” or “I will switch to repayment”.

Sadly, when the term was over either the person living in the house did not want to leave or the property was not worth what they bought it for to cover the mortgage (negative equity). In other cases the repayment amount a month was horrendous as there was little time left in the term to pay it off.